Australian Bitcoin Exchanges

BTC Markets

‘Trade with confidence on Australia’s fastest crypto exchange.’*

Australian Based

✓

Multiple layers of account security.

✓

Fast trade executions with 99.99%.

✓

100% Australian-based support.

✓

Trade crypto on the go with App.

Independent Reserve

‘Helping Australians Invest in Crypto Since 2013’*

Since 2013

✓

ISO 27001 Certified

✓

24/7 Support

✓

Sydney Based

✓

Instant Deposits (Credit Card)

CoinSpot

Everything you need to start a new business.

Great For New Users

✓

Home for 2.5 million people

✓

Blockchain Australia Certified

✓

Melbourne Based

✓

Two-factor authentication

Learn how to buy Bitcoin (BTC) with our comprehensive step-by-step guide. From understanding Bitcoin to choosing the right exchange.

‘Welcome to our comprehensive guide on how to buy Bitcoin! Whether you’re a complete beginner or looking to expand your knowledge, our step-by-step guide will help you navigate the exciting world of Bitcoin investments.

What is Bitcoin?

Our comprehensive suite of professional services caters to a diverse clientele, ranging from homeowners to commercial developers.

What is Bitcoin?

Bitcoin is a decentralised digital currency that enables peer-to-peer transactions without the need for a central authority. It was created in 2009 by an anonymous individual or group known as Satoshi Nakamoto. Powered by blockchain technology, Bitcoin offers security, transparency, and the potential for high returns, making it an attractive investment option.

Preparing to Buy Bitcoin.

Before buying Bitcoin, it’s crucial to do your homework. Start by selecting a secure wallet to store your Bitcoin. Research and choose a reputable exchange that suits your needs. Stay informed about market trends to make an educated purchase.

Securing Your Bitcoin

Keeping your Bitcoin secure is paramount. Use a hardware wallet like Ledger or Trezor for offline storage. Enable two-factor authentication on all accounts and regularly update your passwords. By following these steps, you can protect your investment from potential threats.

What are the risks of buying Bitcoin?

Risks include market volatility, hacking and security breaches, regulatory changes, and the potential for loss if you forget your wallet credentials. Always stay informed and take necessary precautions to mitigate these risks. The Risks are many and you should always seek the right information.

How do I choose the best Bitcoin exchange in Australia?

When choosing a Bitcoin exchange in Australia, consider factors like security features, user-friendliness, fees, supported currencies, and customer support. Popular exchanges in Australia include CoinSpot, BTC Markets, Independent Reserve, and Swyftx.

Is buying Bitcoin legal in Australia?

Yes, buying Bitcoin is legal in Australia. The Australian government has clear regulations in place for cryptocurrency exchanges, requiring them to register with AUSTRAC (Australian Transaction Reports and Analysis Centre) to ensure compliance with anti-money laundering and counter-terrorism financing laws.

How To Buy Bitcoin FAQ’s

Are there any fees for buying Bitcoin?

Yes, there are usually fees associated with buying Bitcoin, including exchange fees, transaction fees, and withdrawal fees. These fees vary by exchange and payment method, so it’s important to review fee structures before making a purchase.

What are the tax implications of buying Bitcoin in Australia?

In Australia, Bitcoin and other cryptocurrencies are considered assets and are subject to capital gains tax (CGT). This means that any profit made from selling Bitcoin is taxable. It’s important to keep detailed records of all transactions and consult a tax professional for guidance.

What is the difference between a Bitcoin exchange and a Bitcoin broker?

A Bitcoin exchange is a platform where users can buy and sell Bitcoin directly with other users, while a Bitcoin broker facilitates the buying and selling of Bitcoin for a fee. Brokers often offer more convenience and simplified processes but may charge higher fees.

Can I use Bitcoin for purchases in Australia?

Yes, many Australian merchants and online platforms accept Bitcoin as payment. You can use Bitcoin to buy goods and services, pay for travel, and even donate to charities. Some Australian businesses that accept Bitcoin include certain cafes, online retailers, and service providers.

What is KYC and why is it necessary?

KYC (Know Your Customer) is a verification process that requires users to provide identification to comply with legal and regulatory standards. In Australia, KYC is mandatory for cryptocurrency exchanges to prevent fraud, money laundering, and other illegal activities.

How do I track the price of Bitcoin?

You can track the price of Bitcoin using various financial news websites, cryptocurrency market aggregators (like CoinMarketCap or CoinGecko), and mobile apps designed for real-time price tracking.

What is dollar-cost averaging (DCA)?

Dollar-cost averaging (DCA) is an investment strategy where you buy a fixed amount of Bitcoin at regular intervals, regardless of its price. This approach reduces the impact of market volatility and avoids trying to time the market.

What is the best time to buy Bitcoin?

There is no definitive best time to buy Bitcoin due to its market volatility. Some investors use strategies like dollar-cost averaging (DCA), which involves buying small amounts regularly to mitigate the impact of price fluctuations.

What is a Bitcoin wallet?

A Bitcoin wallet is a digital tool that allows you to store, send, and receive Bitcoin. Wallets can be software-based (online or mobile apps) or hardware-based (physical devices). Popular options include Ledger, Trezor, Electrum, and Exodus.

What is dollar-cost averaging (DCA)?

Dollar-cost averaging (DCA) is an investment strategy where you buy a fixed amount of Bitcoin at regular intervals, regardless of its price. This approach reduces the impact of market volatility and avoids trying to time the market.

Bitcoin matters because it represents a paradigm shift in the way we think about money, power, and financial freedom. By decentralising control and democratising access, Bitcoin empowers individuals to take charge of their financial lives, unhindered by borders, institutions, or governments. As a secure, transparent, and immutable store of value, Bitcoin offers a beacon of hope for those disenfranchised by traditional systems, and a catalyst for innovation in the digital age. Its existence challenges the status quo, ignites new possibilities, and forever changes the fabric of our global economy.

The Bitcoin White Paper

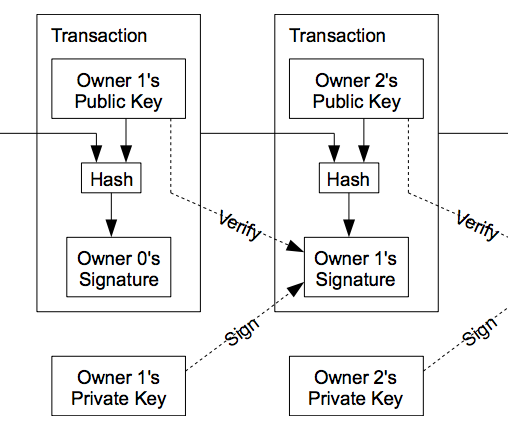

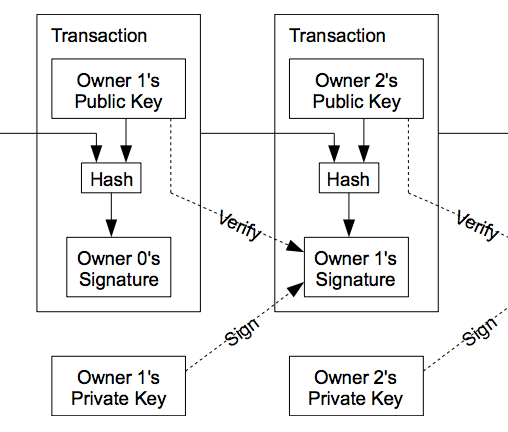

- Decentralised Digital Currency: Bitcoin is a decentralised digital currency that allows for peer-to-peer transactions without the need for a trusted third party.

- Blockchain Technology: Bitcoin uses a distributed digital ledger called the blockchain to record transactions, ensuring the integrity and transparency of the network.

- Cryptographic Security: Bitcoin utilises advanced cryptography to secure transactions and control the creation of new units.

Satoshi Nakamoto

- Limited Supply: The total supply of Bitcoin is capped at 21 million, preventing inflation and maintaining the value of each coin.

- Mining and Consensus: New Bitcoins are created through a process called mining, which requires powerful computers to solve complex mathematical problems, securing the network and verifying transactions.

- Open-Source and Community-Driven: Bitcoin is an open-source project, allowing developers to review and contribute to the code, and its decentralised nature ensures that no single entity controls the network.

“Bitcoin is the beginning of something great: a currency without a government, something necessary and imperative.”

Nassim Nicholas Taleb

Safest and Most Cost-Effective Methods to Buy Bitcoin in Australia During Market Volatility?

Buying Bitcoin in a volatile market can be daunting, but by choosing the right methods, you can ensure both safety and cost-effectiveness. Here’s how you can approach this in Australia:

1. Use Reputable Australian Exchanges. Buying Australian Matters.

Why it’s Safe:

Australian-based exchanges comply with local regulations, offering better protection under Australian law. They are also more likely to have secure systems in place to protect user funds and data.

Top Choices:

Swyftx: Offers two-factor authentication (2FA) and biometric login, along with a transparent fee structure.

Independent Reserve: Known for its robust security measures and insurance against hacks.

Cost-Effectiveness:

- Compare fees across exchanges. Some, like BTC Markets, offer lower trading fees, especially for high-volume trades, which is crucial during volatile times when you may want to trade quickly and affordably.

- Consider using exchanges that offer fee rebates or discounts for using their native tokens (e.g., Binance Australia).

2. Utilize Dollar-Cost Averaging (DCA)

Why it’s Safe:

- DCA involves buying small amounts of Bitcoin at regular intervals, regardless of the price. This strategy reduces the risk of making large purchases at high prices during volatile periods.

How to Implement:

- Set up automatic purchases on platforms like CoinSpot or Swyftx. These platforms allow you to automate your DCA strategy, buying a fixed amount of Bitcoin weekly or monthly.

Cost-Effectiveness:

This method helps in averaging out the purchase price, reducing the impact of short-term volatility. You avoid the stress of trying to time the market, which can often lead to costly mistakes.

3. Use Limit Orders to Control Purchase Price

Why it’s Safe:

- Limit orders allow you to set a specific price at which you want to buy Bitcoin. This ensures that you don’t overpay during sudden price spikes, a common occurrence during market volatility.

Best Practices:

- Most Australian exchanges like CoinJar and Digital Surge offer limit orders. Set your buy price at a level you’re comfortable with, and let the exchange do the rest.

Cost-Effectiveness:

By using limit orders, you can avoid the premium prices that often accompany market orders during volatility, ensuring you get the best possible deal.

4. Consider Peer-to-Peer (P2P) Platforms

How it Works:

- P2P platforms like Paxful or LocalBitcoins allow you to buy directly from other users, often at better rates. Ensure the platform offers escrow services, which hold the Bitcoin until both parties have fulfilled their part of the deal, reducing the risk of fraud. There is still considerable risk in this process.

Cost-Effectiveness:

P2P platforms often have lower fees compared to traditional exchanges, especially when buying in larger amounts. You can also find sellers offering Bitcoin at competitive prices during market dips.

5. Secure Your Bitcoin with Cold Storage

Why it’s Safe:

- Once you’ve purchased Bitcoin, moving it to a cold wallet (offline storage) like a Ledger Nano S or Trezor ensures it’s safe from online threats. Cold storage is critical during volatile times when exchange hacks and phishing attempts are more common.

Cost-Effectiveness:

While there’s an initial cost to buying a cold wallet, it’s a one-time investment that protects your Bitcoin from being stolen, which is invaluable in the long term.

6. Monitor the Market and Stay Informed

Why it’s Safe:

- Staying informed about market conditions can help you make better decisions. Use tools like CoinGecko or TradingView to set alerts for significant price movements or news updates.

Cost-Effectiveness:

By staying informed, you can avoid panic selling or buying, which are common during volatile times and often lead to financial losses.